Dynamic business environment, effective risk management is essential for sustainability and growth. Companies face a myriad of risks, from financial uncertainties to cybersecurity threats. Implementing robust risk mitigation strategies helps protect assets and ensures operational continuity.

This guide outlines key strategies that every business should consider to safeguard against potential pitfalls. By proactively addressing risks, organizations can enhance resilience and foster long-term success.

Conduct Comprehensive Risk Assessments

Conducting comprehensive risk assessments is crucial for identifying potential threats to your business. Start by gathering a cross-functional team to pinpoint risks across all areas, including operational, financial, and reputational. Evaluate each risk based on its likelihood and potential impact, prioritizing those that pose the greatest threat.

Document your findings in a structured format for ongoing reference and updates. Regularly review and adjust your assessments to reflect changes in the business environment. This proactive approach enables informed decision-making and effective risk management.

Diversify Supply Chains

Diversifying supply chains is essential for mitigating risks associated with dependency on single sources. Start by identifying multiple suppliers for critical materials and services, reducing vulnerability to disruptions. Explore global and local sourcing options to enhance flexibility and resilience.

Establish strong relationships with alternative suppliers to ensure reliability in times of crisis. Regularly assess supplier performance and market conditions to adapt your strategy as needed. This approach not only safeguards against disruptions but also fosters competitive advantages.

Invest in Cybersecurity

Investing in cybersecurity is vital for protecting sensitive business data and maintaining customer trust. Implement robust security measures, such as firewalls and encryption, to safeguard against cyber threats.

Regularly update software and conduct vulnerability assessments to identify potential weaknesses. Train employees on best practices for cybersecurity to reduce human error risks. A proactive cybersecurity strategy helps mitigate financial loss and reputational damage from breaches.

Develop a Strong Business Continuity Plan

Developing a strong business continuity plan is essential for ensuring operational resilience during crises. Start by conducting a thorough risk assessment to identify potential threats to your business. Outline clear procedures for maintaining critical operations, including communication protocols and resource allocation.

Designate a response team responsible for implementing the plan during emergencies. Regularly test and update the plan to reflect changes in the business environment and personnel. This proactive approach minimizes downtime and helps protect your organization’s reputation.

Strengthen Employee Training Programs

Strengthening employee training programs is crucial for fostering a risk-aware culture within the organization. Begin by identifying key areas where training is needed, such as compliance, safety, and cybersecurity. Implement regular training sessions that incorporate real-life scenarios to enhance understanding and retention.

Encourage continuous learning by providing access to resources and certifications. Create feedback mechanisms to assess training effectiveness and make necessary adjustments. A well-trained workforce not only reduces risks but also empowers employees to contribute to a safer, more resilient organization.

Build Strong Relationships with Insurance Providers

Building strong relationships with insurance providers is essential for effective risk management. Start by communicating your business’s unique needs and risk exposures to ensure tailored coverage. Regularly review your policies with providers to adapt to changing circumstances and market conditions.

Engage in open dialogue about potential risks, which can lead to better insights and advice. Leverage these relationships to negotiate favorable terms and pricing. A collaborative approach enhances trust and ensures prompt support during claims or crises.

Maintain Financial Reserves

Maintaining financial reserves is vital for safeguarding your business against unexpected challenges. Start by establishing a dedicated savings fund that can cover at least three to six months of operating expenses. Regularly review your cash flow and profitability to identify opportunities for building reserves.

Encourage prudent financial practices among team members to prioritize saving and resource allocation. Diversify investments to enhance returns while minimizing risk exposure. A strong financial cushion provides stability and peace of mind during economic downturns or emergencies.

Engage in Legal Compliance and Governance

Engaging in legal compliance and governance is essential for mitigating legal risks and ensuring operational integrity. Begin by staying informed about relevant regulations and industry standards that impact your business. Implement policies and procedures to promote adherence and establish accountability among employees.

Conduct regular audits and assessments to identify compliance gaps and address them promptly. Provide ongoing training to keep staff updated on legal requirements and ethical practices. A strong compliance framework fosters trust and protects your organization from potential penalties and reputational damage.

Monitor Market Trends and Competitors

Monitoring market trends and competitors is crucial for staying competitive and informed. Regularly analyze industry reports and news to identify emerging trends and shifts in consumer behavior. Utilize tools and software to track competitor activities, pricing strategies, and product developments.

Engage with customers through surveys and feedback to gain insights into their preferences and needs. This proactive approach enables you to adapt your strategies and seize new opportunities. Staying informed helps mitigate risks and positions your business for long-term success.

Implement Regular Audits and Assessments

Implementing regular audits and assessments is vital for identifying potential risks and ensuring compliance. Establish a systematic schedule for internal audits across various functions, such as finance, operations, and cybersecurity. Use these assessments to evaluate processes, controls, and overall risk management effectiveness.

Engage third-party auditors for an objective perspective and to uncover blind spots. Analyze findings to make informed decisions and implement necessary improvements. Consistent auditing not only enhances accountability but also fosters a culture of continuous improvement within the organization.

Foster a Culture of Risk Awareness

Fostering a culture of risk awareness is essential for enhancing organizational resilience. Start by integrating risk management into everyday operations and decision-making processes. Provide training and resources to empower employees to identify and report potential risks.

Encourage open communication where staff feel comfortable discussing concerns without fear of repercussions. Recognize and reward proactive risk management behaviors to reinforce their importance. A strong risk-aware culture ensures that all employees contribute to the organization’s overall safety and stability.

Conclusion

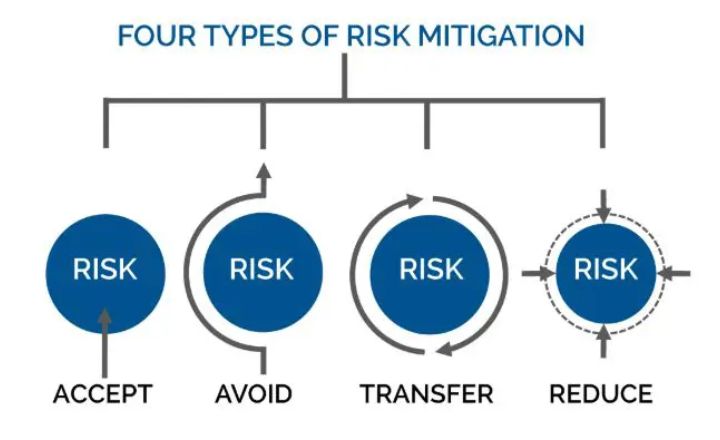

The implementation of effective risk mitigation strategies is vital for safeguarding a business’s future and ensuring its resilience in the face of uncertainties. By conducting thorough risk assessments, diversifying supply chains, investing in cybersecurity, and fostering a culture of risk awareness, organizations can proactively address potential threats.

Strong relationships with insurance providers and maintaining financial reserves further enhance stability. Ultimately, a comprehensive approach to risk management not only protects assets but also positions businesses for sustainable growth and success in an ever-evolving landscape.